Advisory Opinion 37, Computer Assisted Valuation Tools was originally included in the 2018-2019 version of the Uniform Standards of Professional Appraisal Practice (USPAP). So, what does it mean for you? AO-37 clarifies the scope of computer-assisted valuation tools related to appraisers and their responsibilities. These tools gather and analyze market data, and when used correctly, can add credibility to completed appraisals. AO-37 also reminds appraisers of their responsibility for the entire valuation process. Appraisers cannot use software or valuation tools to shield themselves from scrutiny.

History

The history of Advisory Opinion 37 starts way back in 1997 when the Appraisal Standards Board (ASB) adopted Advisory Opinion 18. This AO set forth guidance for the use of Automated Valuation Models (AVMs). AO-18 clarified that appraisers can use AVMs as the basis for appraisals, although the output alone is not sufficient as an appraisal. AO-18 went into effect in the 1998 version of USPAP. As the ASB reviewed AO-18 for the upcoming version of USPAP, they considered replacing it. However, after receiving feedback from key stakeholders, they decided against replacing because it is specific to AVMs and still applies.

They decided to issue a new advisory opinion to address a broader range of technologies. The new AO became Advisory Opinion 37, Computer Assisted Valuation Tools. AO-37 clarifies appraisers’ responsibilities while completing an appraisal using online or stand-alone software tools. AO-37 cites fourteen sections of USPAP, advising appraisers on more sections of USPAP than many other Advisory Opinions. Here are some important takeaways.

Advisory Opinion 37 Interpreted

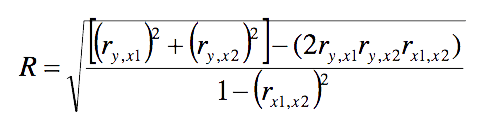

AO-37 cites issues appraisers face when relying on software or online resources to complete their appraisals. The AO addresses two broadly-used technologies — Regression Analysis and Multiple Listing Services — to illustrate the role of software tools in the valuation process. The main message of this AO is that technology can build credibility in appraisals as long as appraisers apply it correctly to support their decisions. Conversely, they can hurt credibility and valuation results if used incorrectly.

Supporting Adjustments

As mentioned in the AO, tools can support adjustments if appraisers are aware of the information used as the input and how to properly apply the output. Some tools offer data analysis or data visualization to assist appraisers in the valuation process while providing support for their decisions and conclusions.

Some tools offer data analysis or data visualization to assist appraisers in the valuation process while providing support for their decisions and conclusions.

Scope of Work

One major responsibility for appraisers is determining the scope of work for the appraisal assignment. Because of this, appraisers must understand the assignment to make informed decisions regarding the process required. Appraisers must control the process, selection and input of information based on their knowledge and experience. If appraisers allow their software or tools to control the entire process the output may result in less credibility and/or misleading and unreliable results. Instead, appraisers should control determination of the process, data selection, parameter analysis and interpretation of the output.

Competency

According to the USPAP Competency Rule, appraisers must identify the problem being addressed; maintain the knowledge and experience to complete the assignment, and recognize and comply with laws and regulations that apply to the appraiser or the assignment.

The AO states that the Competency Rule applies to appraisers’ familiarity with specific types of property or assets, market, geographic areas, intended use, specific laws or regulations, or analytical methods, etc. Appraisers must also understand how to apply their knowledge with or without computer-assisted tools. Basically, appraisers must understand the basic tenets of appraisals. Appraisers must be able to use tools properly. Luckily, appraisers don’t need to know the formulas used by their tools or any algorithms and/or proprietary information about, or contained in it. AO-37 states “However, the appraiser should be able to describe the overall process and verify that the computer-assisted valuation tool is consistent in producing results that accurately reflect prevailing market behavior for the property that is being analyzed.”

Responsibilities

Appraisers are responsible for selecting the input parameters AND for affirming the inputs are entered correctly. This demonstrates that appraisers understand the market and has tested the software to make sure it works. Appraisers must also understand how to apply the results of the calculations. For example, appraisers must be able to determine what constitutes a strong relationship between variables from supporting materials such as graphs and tables. Appraisers cannot simply rely on the results of a given software or other tools unless they have reviewed it to ensure its reliability.

Terminology

Appraisers must understand the terminology used by their computer-assisted valuation tools. Terms like standard deviation, coefficient of variation, degrees of freedom, etc., have specific meanings and specific applications. The best-case scenario if you use terms like these incorrectly is loss of credibility. The worst-case scenario is incorrect or unsupported value conclusions and reports. One review appraiser recently told me that he often sends reports back to appraisers because they use terms incorrectly or in a misleading way.

Conclusion

When using computer-assisted valuation tools make sure the outputs or results make sense with respect to prevailing market behavior. They’ve got to pass the eye test. Remember, no software can replace your knowledge or experience. The AO states “Regardless of the tool chosen, the appraiser is responsible for the entire analysis including…controlling input, the calculations, and the resulting output.”